SciELO - Brasil - The Earnings/Price Risk Factor in Capital Asset Pricing Models The Earnings/Price Risk Factor in Capital Asset Pricing Models

An Empirical Test of the Fama-French Five-Factor Model: Applicability to Equitized State-Owned Enterprises in Vietnam | Semantic Scholar

The Comparison of Fama-French Five-Factor Model in Chinese A-share Stock Market and in Real Estate Sector | Semantic Scholar

![PDF] Are Profitability and Investment Good Proxies for Risk Factors The Analysis on Fama and French's Five-Factor Model | Semantic Scholar PDF] Are Profitability and Investment Good Proxies for Risk Factors The Analysis on Fama and French's Five-Factor Model | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/2b48dabf71a6314125bda4b3d79e056b3f0c541c/2-TableI-1.png)

PDF] Are Profitability and Investment Good Proxies for Risk Factors The Analysis on Fama and French's Five-Factor Model | Semantic Scholar

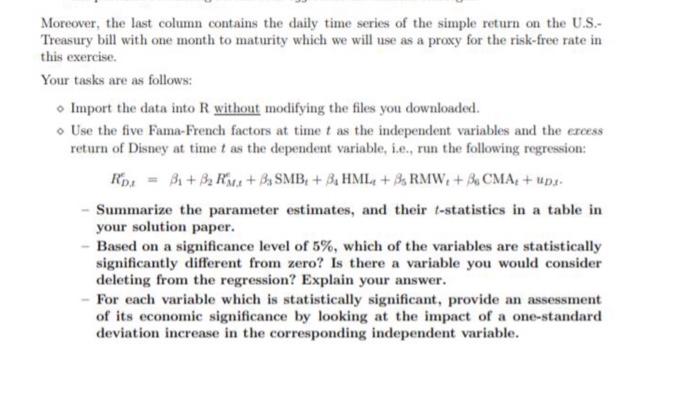

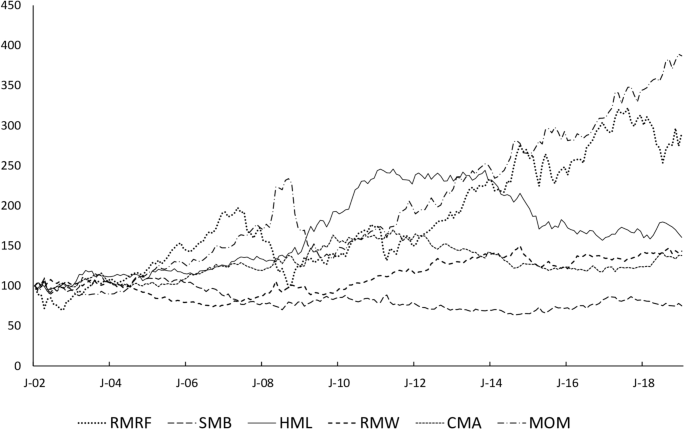

Comparison of CAPM, Three-Factor Fama-French Model and Five-Factor Fama-French Model for the Turkish Stock Market | IntechOpen