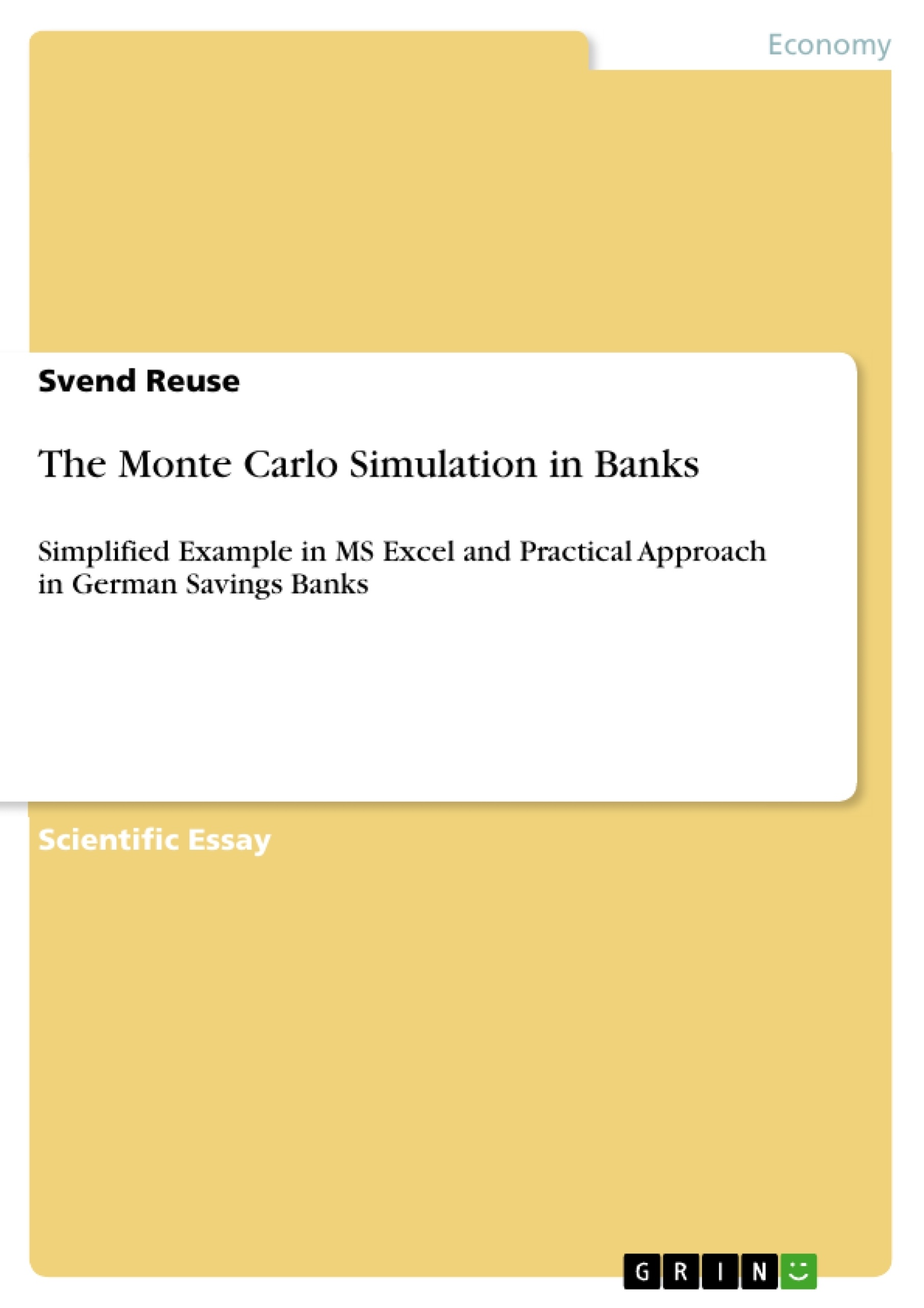

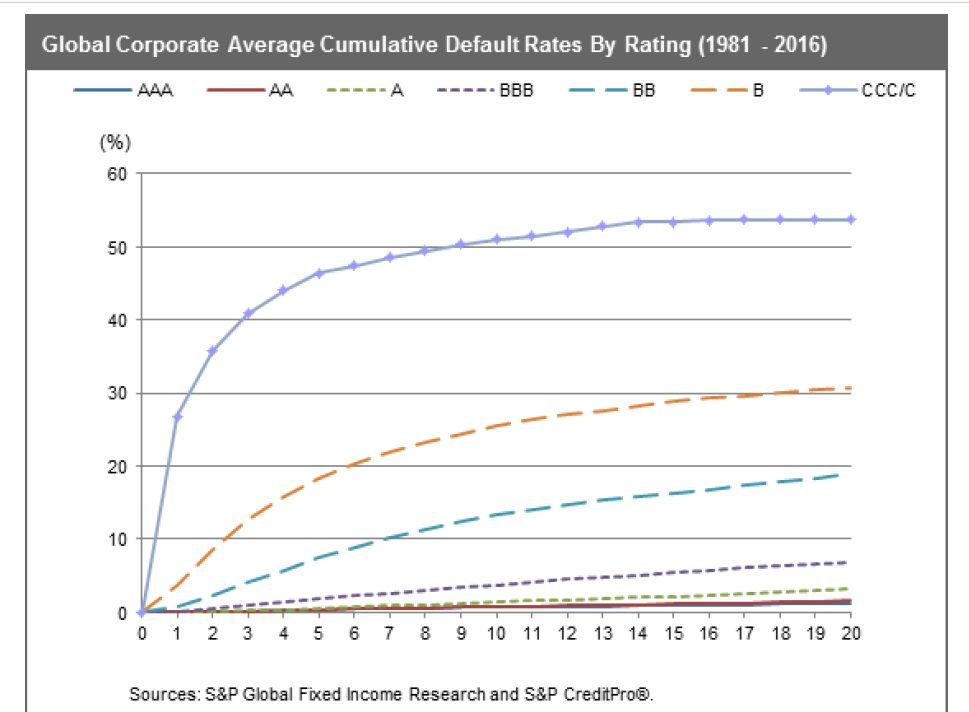

A dynamic approach merging network theory and credit risk techniques to assess systemic risk in financial networks | Scientific Reports

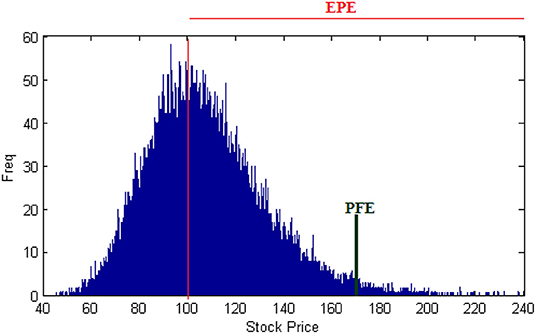

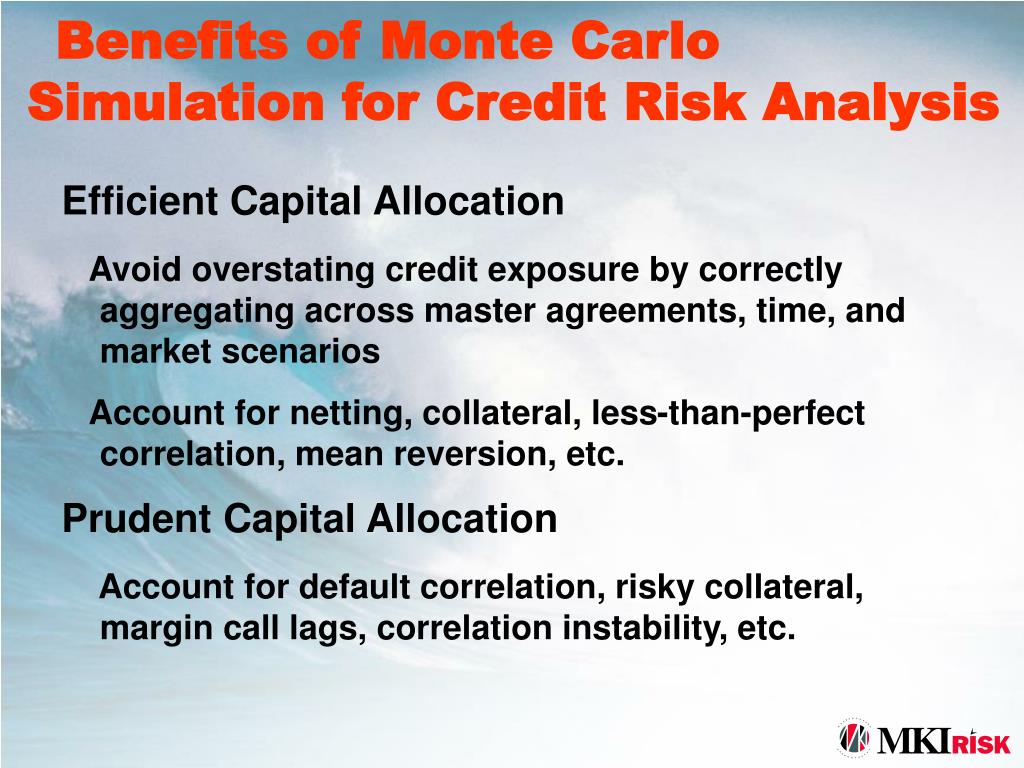

Frontiers | Evaluating Credit Counterparty Risk of American Options via Monte Carlo Methods: A Comparison of Tilley Bundling and Longstaff-Schwartz LSM

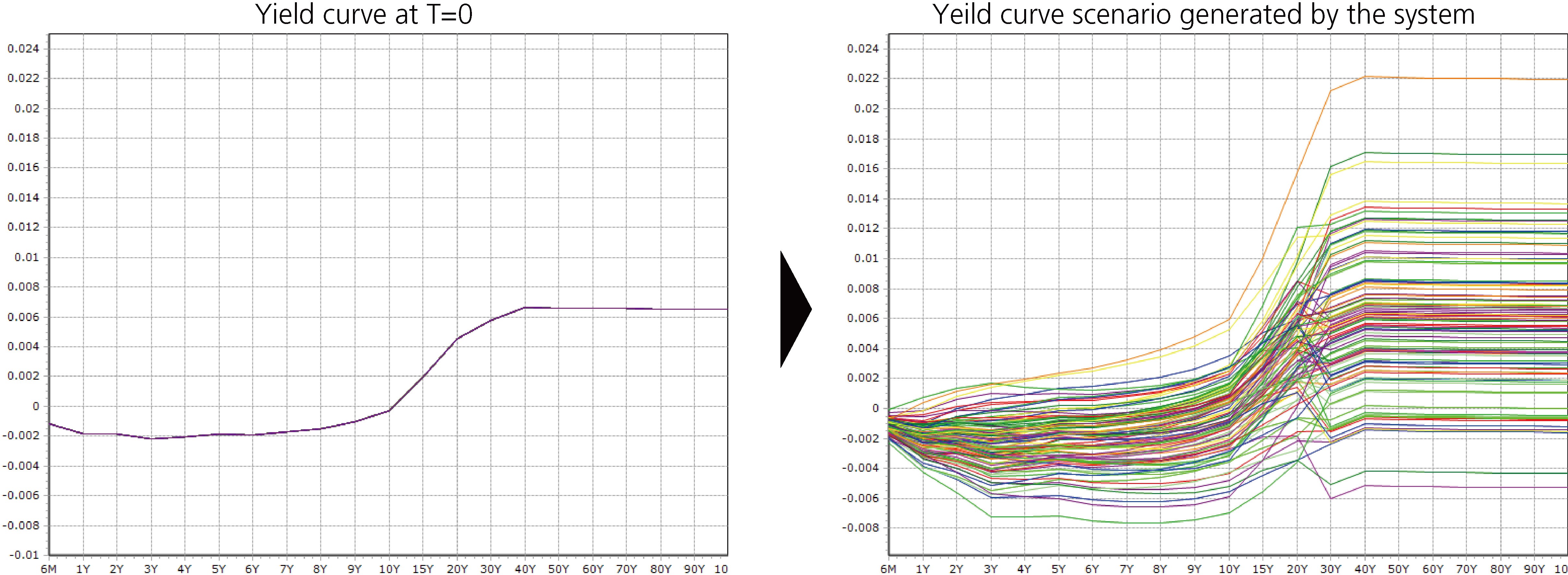

Settlement and Credit Risk Exposures from 100 Monte Carlo Simulation... | Download Scientific Diagram

How Monte Carlo simulations can help treasurers model risk | The Association of Corporate Treasurers

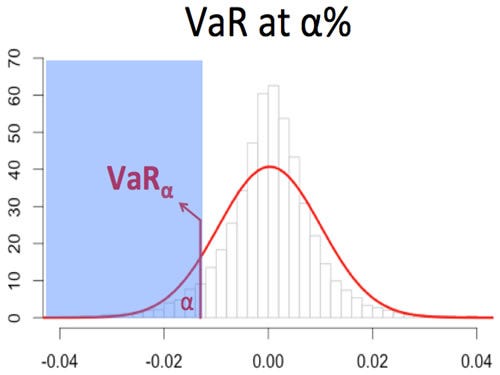

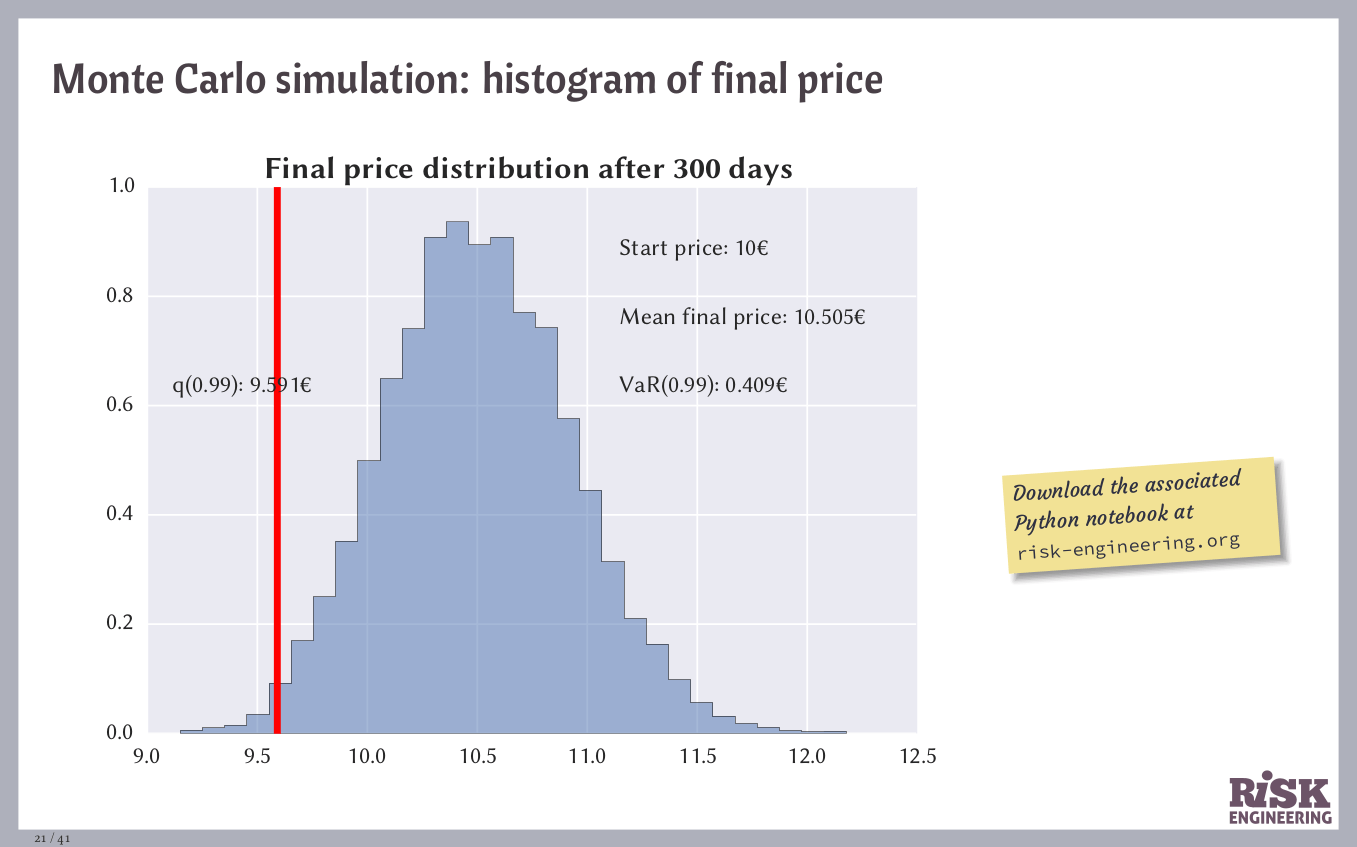

Here we show a visual depiction of the Value‐at‐Risk (VaR) estimation... | Download Scientific Diagram

![PDF] Efficient Monte Carlo Simulation for Counterparty Credit Risk Modeling | Semantic Scholar PDF] Efficient Monte Carlo Simulation for Counterparty Credit Risk Modeling | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/41822669d9c48b69f56f807f63883b6d204cda27/44-Table5.1-1.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Introduction_To_Counterparty_Risk_Feb_2020-01-7ca9701dd456437b8ea0a1ee95dc04ed.jpg)

:max_bytes(150000):strip_icc()/DDM_INV_monte-carlo_df-ae0eb86b9ba54d079245063076f3cf0f.jpg)